The Main Principles Of Hsmb Advisory Llc

The Main Principles Of Hsmb Advisory Llc

Blog Article

Indicators on Hsmb Advisory Llc You Need To Know

Table of Contents5 Simple Techniques For Hsmb Advisory LlcFacts About Hsmb Advisory Llc UncoveredHsmb Advisory Llc Things To Know Before You Get ThisNot known Factual Statements About Hsmb Advisory Llc Our Hsmb Advisory Llc PDFsHsmb Advisory Llc - An OverviewThe Best Strategy To Use For Hsmb Advisory Llc

Likewise know that some plans can be expensive, and having specific health problems when you apply can raise the costs you're asked to pay. St Petersburg, FL Life Insurance. You will certainly require to make certain that you can manage the premiums as you will certainly need to commit to making these settlements if you want your life cover to stay in locationIf you really feel life insurance policy might be beneficial for you, our collaboration with LifeSearch permits you to obtain a quote from a number of suppliers in dual fast time. There are various types of life insurance policy that aim to satisfy different protection demands, including level term, decreasing term and joint life cover.

Little Known Facts About Hsmb Advisory Llc.

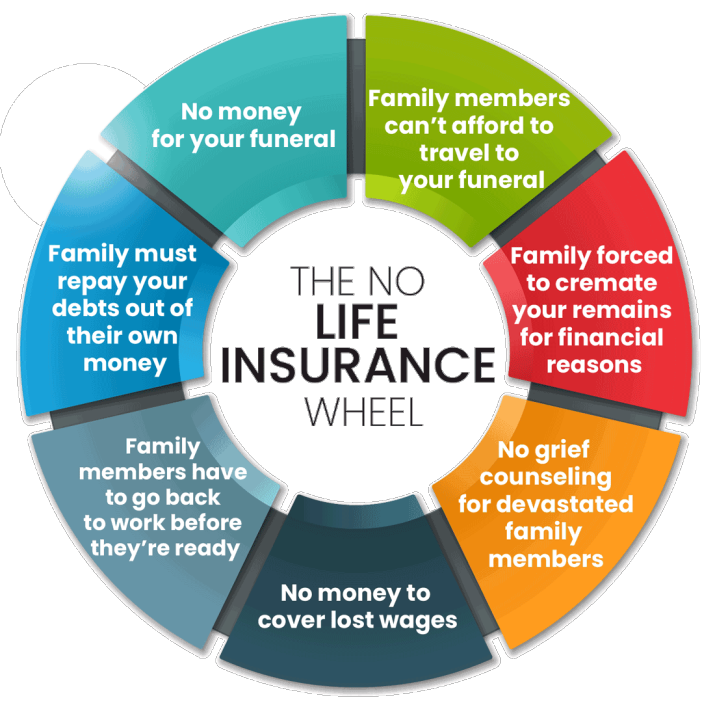

Life insurance policy offers 5 economic advantages for you and your family (Insurance Advise). The primary benefit of adding life insurance policy to your financial strategy is that if you pass away, your heirs receive a round figure, tax-free payment from the policy. They can utilize this cash to pay your final costs and to change your income

Some plans pay out if you develop a chronic/terminal health problem and some supply cost savings you can use to sustain your retirement. In this article, discover the various benefits of life insurance policy and why it may be an excellent concept to purchase it. Life insurance policy uses advantages while you're still alive and when you pass away.

Not known Details About Hsmb Advisory Llc

If you have a policy (or policies) of that size, the people who rely on your revenue will still have money to cover their continuous living expenses. Recipients can make use of policy benefits to cover essential everyday costs like rental fee or home loan payments, utility expenses, and groceries. Average annual expenses for families in 2022 were $72,967, according to the Bureau of Labor Stats.

How Hsmb Advisory Llc can Save You Time, Stress, and Money.

Additionally, the money worth of entire life insurance coverage expands tax-deferred. As the cash value builds up over time, you can utilize it to cover costs, such as purchasing a car or making a down settlement on a home.

If you choose to obtain versus your cash money worth, the lending is not subject to earnings tax obligation as long as the policy is not given up. The insurance business, however, will certainly bill passion on the finance quantity until you pay it back (https://www.giantbomb.com/profile/hsmbadvisory/). Insurer have varying rate of interest on informative post these loans

Hsmb Advisory Llc - An Overview

For example, 8 out of 10 Millennials overestimated the price of life insurance coverage in a 2022 research. In reality, the typical cost is better to $200 a year. If you believe spending in life insurance coverage may be a clever monetary action for you and your household, consider consulting with a financial consultant to embrace it right into your monetary plan.

The 5 primary sorts of life insurance policy are term life, whole life, global life, variable life, and last cost coverage, likewise recognized as burial insurance coverage. Each type has various attributes and advantages. As an example, term is extra economical but has an expiration day. Entire life starts costing more, but can last your entire life if you maintain paying the costs.

The Facts About Hsmb Advisory Llc Revealed

Life insurance can likewise cover your mortgage and give money for your household to maintain paying their expenses (https://www.wattpad.com/user/hsmbadvisory). If you have family members depending on your earnings, you likely require life insurance coverage to support them after you pass away.

Essentially, there are 2 sorts of life insurance policy plans - either term or long-term strategies or some combination of both. Life insurance companies use different kinds of term plans and typical life plans along with "interest delicate" items which have ended up being more prevalent since the 1980's.

Term insurance provides protection for a given period of time. This period could be as brief as one year or offer protection for a specific number of years such as 5, 10, 20 years or to a specified age such as 80 or sometimes as much as the oldest age in the life insurance death tables.

Rumored Buzz on Hsmb Advisory Llc

Presently term insurance policy prices are really competitive and amongst the most affordable traditionally skilled. It should be kept in mind that it is an extensively held idea that term insurance policy is the least costly pure life insurance coverage readily available. One needs to evaluate the plan terms thoroughly to choose which term life alternatives appropriate to meet your specific conditions.

With each brand-new term the costs is raised. The right to renew the plan without evidence of insurability is a vital benefit to you. Otherwise, the threat you take is that your health might degrade and you might be not able to obtain a policy at the very same prices and even in all, leaving you and your beneficiaries without insurance coverage.

Report this page